When clients request an evaluation of their financial position, accounting firms typically use financial planning software and tools. Many people are able to achieve similar results using open-source financial software or customized spreadsheets.

I highly recommend that anyone considering at-home financial tests use some form of financial tracking tool, whether it comes in the form of spreadsheets or software. Much harm comes from relying on “gut-feeling” that is often false unless examined under the microscope of math and the science of financial figures.

If you are unfamiliar with financial software, you may want to work with a professional. Regardless, this article will be of value in determining financially distressing issues that do not require financial planning tools or software.

In part one of this series, we discussed the financial aspects of employee benefits/contract review, health insurance, and taxes. This article looks at liability management and cash flow management.

LIABILITY MANAGEMENT — STUDENT LOANS TO MORTGAGES

Not everyone starts out with the same amount of debt, and not everyone has the same income to leverage for acquiring new types of debt to fund different goals. Never presume that everyone who graduated from medical school and finished their residency program is on the same boat with you, sharing the same cargo. Everyone has their own boat and their own cargo. How you manage the boat is important to “getting there,” but remember that the weight of the boat will always be a factor. Let’s do an audit of what “cargo” is on your “boat.”

Student Loans

If you do not have student loans to repay, congratulations, you can skip this section. This is a huge “anchor” that can weigh on your financial situation and cause you to delay many of your life milestones, such as buying a home, affording expensive hobbies, and building wealth. I suggest you review my July/August PLJ article, ”A Practical Guide to Physician Student Loan Decision Making,” to help you develop an effective strategy to pay these down.

That being said, you will either need a strategy to “live with the pain” while achieving life milestones, or you will need to slow down progress toward your life milestones to remove this financial anchor. Several free calculators are available to help you create a plan to repay student loans, but you should also consult with a specialist to help navigate the changing legislation and the availability of new student loan repayment strategies.

Mortgages

Those who plan to finance their homes have a few decisions to make, including “how much home” versus “how much debt” to take on for the home. In general, most banks will not allow you to exceed 50% debt-to-income (DTI) but generally lend on preferential terms at a DTI around 36%.

This means that many of you who were under the illusion that becoming a doctor and earning a substantial income would automatically line you up for a great first home may need to become daily interest rate watchers. The reason comes down to the math of mortgages.

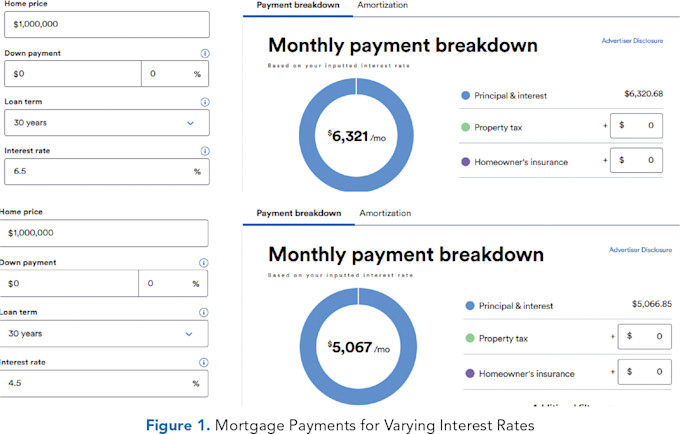

Without considering any costs associated with creating the loan or the insurance and taxes that are also collected, note the two scenarios illustrated in Figure 1.

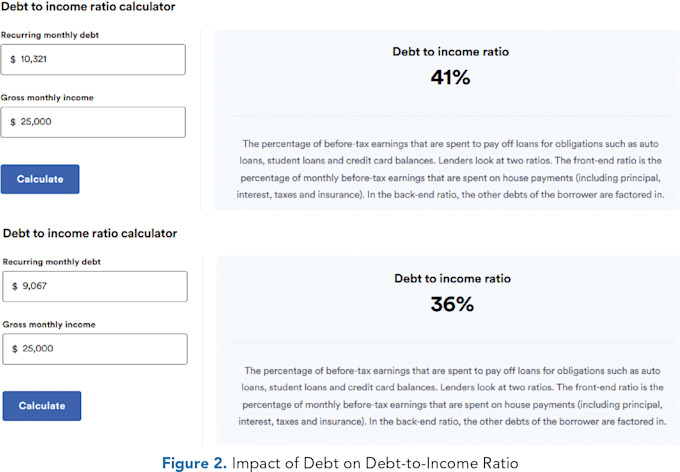

On a $1 million loan with no down payment, a 2% difference in a 30-year loan comes out to about a $1,300 a month difference in payment. However, when it comes to DTI, imagine someone who earns a salary of $300,000 trying to manage each of these scenarios with a $4,000 monthly student loan payment (Figure 2). Very quickly, you can see that the “financial anchor” from earlier may weigh down your ability to borrow in the first scenario, while in the second scenario, you are well within the clear of the 36% DTI for your loan.

The prevailing interest rates are largely out of your immediate control. However, you can manage your existing liabilities and take steps that may help lower your mortgage payments. You might want to consider:

Building a stronger down payment. Although you can leverage your considerable earnings power to finance your lifestyle and dreams, know that a stronger down payment will directly lower your monthly mortgage costs, which will allow you to mitigate the impact of higher interest rates by lowering the payments associated with those higher interest rates.

Paying off (meaningfully) certain debts. That expensive car you financed as a “gift” to yourself after completing medical school? Paying off that loan will add that $1,000+ back to your DTI calculations a lot faster than $20,000 going into SOME of your student loans. As always, look through how much more money you “get back” when you pay down some of your debts versus just putting large chunks of cash toward loans based on the feelings associated with those debts.

Avoiding “bad” debts. If you are adept at cash flow management (discussed below), you should be able to avoid “bad” debts. However, if credit cards from medical school/ residency are still active, paying them off will also help you more substantially and potentially improve your credit score by lowering your total credit utilization ratio.

When calculating your DTI and mortgage payments, you can use free software available online. However, for those considering refinancing or adding rental properties, I highly recommend working with a financial professional who is knowledgeable and familiar with modeling the costs associated with rental properties and homeownership to help you calculate the actual return on investment from the purchase of your properties versus other passive investment types.

Snowball versus Avalanche Approaches to Debt Payment

Rather than go into every kind of debt that you can have, let’s lump them all up as “bad” and go with how best to pay them off and why. Here are two methods. Note that in both cases, you should always make your minimum required payments.

Snowball Method: Start with the smallest balances and work your way up to the larger balances. You close out accounts faster initially, while your longer-term debts may grow slightly faster and cost you more.

Avalanche Method: Start with the highest interest rate and pay down from there. You close everything out faster overall, but you don’t get to officially close out accounts as fast initially.

Neither of these methods is as effective as cash flow management, which is discussed next. This is because most highly compensated individuals can pay off debts before they really require the snowball or avalanche methods. Either they can use their bonuses or actively pay down their debts much faster when they put their minds to it.

In this case, the best cure is not to develop the sickness. If you do develop the sickness, cure the underlying issue. Don’t just treat the symptom.

CASH FLOW MANAGEMENT —

BUDGETING BY YOURSELF AND WITH A PARTNER

Like it or not, developing a budgeting strategy is an essential step in managing your finances. The good news is that it does not always have to be a monthly chore. You may already be in a financial situation where you can skip straight to not budgeting, also called “reverse budgeting.”

Here are descriptions of three types of budgeting so you can determine the one that will best work for you.

Traditional Budgeting

Optimal for those who need to stretch a low or fixed income every month.

When people hear the term “budgeting,” they usually think of traditional budgeting, which requires individuals to outline their expected income and expenses for the month and set intended limits for each category of expenses.

This sort of detailed budgeting works best with a tracking resource. Options include online tools like YNAB (You Need A Budget) or Credit Karma, or software that has accounting functions (Excel spreadsheets). This time-intensive approach is unlikely to work well for busy professionals because it requires consistent attention and discipline to maintain. However, it can:

Provide a detailed understanding of spending habits.

Be tailored to specific financial goals, such as debt payoff.

Reverse Budgeting

Optimal for those who are already saving enough toward their financial goals.

Reverse budgeting focuses on savings goals. Instead of starting with expenses, you’ll figure out how much you need to save monthly to meet your retirement, college, travel, and other goals. If you’re meeting those savings goals monthly, you don’t need to track the rest of your spending in detail. Set up automatic account transfers to meet your monthly savings goals without fail, then ensure those funds are also invested automatically, if appropriate. This type of budgeting works only if you have excess cash flow every month.

The benefits are:

Can be hands-off. Very little time or maintenance is required.

Guarantees a specific saving rate.

Flow-Based Budgeting

Optimal for those wondering, “Where does the money go?” each month.

Flow-based budgeting is all about narrowing the scope of money decisions. Instead of looking at your “needs” versus “wants” in your budget, flow-based budgeting assesses what is automated versus what requires an active spending decision.

To practice flow-based budgeting, designate three different accounts or cards, one for each of the following three categories.

Fixed Account: This account is for monthly commitments already on autopay, like your mortgage, subscriptions, and utilities. This account is also for standing commitments you’ve made, even if there isn’t a true autopayment set up. For instance, it would work well for standing bi-weekly therapy appointments.

Flex Account: This account is for expenses that require an active spending decision (e.g., groceries, gas). Make an initial estimate of weekly expenses, add some cushion to it, and replenish the account each Saturday.

Non-Monthly Account: This account is for expenses that tend to come up annually or sporadically and are larger. Think property taxes, annual travel, and car maintenance.

Any of these approaches can work individually or for a couple who share accounts. When you’re budgeting with a partner, how will you split expenses? Here are some strategies.

50/50 Budgeting

Optimal for couples who earn roughly the same amount of money or otherwise prefer a 50/50 approach.

Each partner deposits a fixed, equal amount into a joint account monthly. Then, they both pay agreed-upon expenses from the joint account. All other income is deposited into individual accounts. This option is pretty easy to set up and understand.

Proportional to Income

Optimal for dual-income couples, particularly if they have a significant difference in income.

Split joint expenses based on each partner’s share of the total combined income. For example, Partner A, making a $120k salary, pays 60%, and Partner B, making $80k, pays 40%. Individual expenses can still be paid from individual accounts.

Note: Remember that income is not just your salary. It can also include investment income, trust distributions, cash gifts, etc., if those factors are relevant to your financial situation.

Allowance-Based

Optimal for couples with kids or couples when one partner provides a larger share of unpaid labor.

Deposit a fixed dollar amount into each individual account monthly. This works like an “allowance” for each partner to use freely or save. Other income is deposited into a joint account. In effect, joint expenses are split based on each partner’s percentage of the total income. What makes the allowance approach different is that it guarantees the amount each partner gets in their individual account monthly is equal, regardless of who makes more money.

Pro tip: We often encounter couples who have been splitting expenses by category. For example, one partner pays for rent while the other pays for food. Don’t use this approach! This tends to be the accidental setup that couples fall into because they didn’t make an intentional plan for splitting expenses. This regimen ultimately becomes the murkiest and most challenging to revise over time as costs and income levels fluctuate.