Summary:

Competing in today’s global digital economy requires increasingly complex contributions: Employees need to be motivated to go above and beyond; customers need to be inspired, and their feedback needs to be incorporated; and the demands, opinions, and goals of civil society and government are also critical.

For decades, much of management theory has started by modeling the relationship between a principal and an agent. The principal wants their agent(s) to perform a task or function but can’t always monitor or evaluate their efforts — which means the agent can decide whether to fulfill their assigned tasks or shirk. In order to solve this “agency problem,” scholars have suggested shareholders incentivize senior managers based upon shareholder value. Senior executives can then hold managers accountable for key performance indicators, which contribute to shareholder value.

Within this logic, a sense of shared purpose can offer a useful guidepost and inducement for managers on what to do when the terms of their employment contract don’t dictate their next action — for example, how to respond to an unexpected variance, whether to offer an idea for improvement, how much overtime to work, or how hard to try to solve thorny problems.

However, on further reflection, one might question whether modern organizations resemble this simple characterization. Is avoidance of shirking really the problem that determines who wins and who loses in the twenty-first century global economy? Perhaps in the 1970s, when the theory was developed, conglomerate bloat, gold-plating, and corporate complacency were relatively more important. However, in the ensuing 50 years, globalization and technological change have reshaped our economy and the competitive environment in which organizations compete.

It’s time to update our theories of the firm accordingly. Instead of conceiving of the firm as a collection of managers writing contracts specifying roles and tasks and then struggling to get workers to comply, we need to develop theories that better match the organizations we lead, study, advise, and report on.

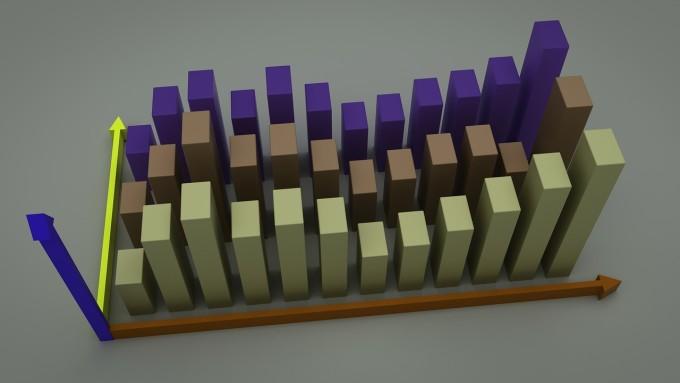

These organizations aren’t struggling to create value because of shirking. They’re struggling because competing in a global digital economy requires increasingly complex contributions that can’t be specified in a contract up front. Employees need to be motivated to go above and beyond the terms of contracts. Customers need to be inspired, and their feedback needs to be incorporated. The demands, opinions, and goals of civil society and government are also critical pieces of the puzzle. Each stakeholder has distinct goals. Some seek value in their investments or loans. Others want a combination of wages or payment and a sense of personal fulfillment. Some are motivated by progress on an issue or cause. Others want to get reelected and use their office for broader purposes.

The value of an organizational purpose is to help coordinate activity among stakeholders in this complex system. Firms are places where these diverse stakeholders come together based on informal understandings of whether, by collaborating, they can better achieve their individual goals. In this manner, firms are not bundles of contracts that principals seek to enforce, but meeting places where a set of stakeholders seek to advance progress toward their goals. Each stakeholder makes decisions about how much and what to contribute and how much to demand and accept in return.

Recent research has argued that relational contracts underpin these systems and hold them together. However, that research to date has focused on such contracts as existing between one principal and one agent, built on a foundation of trust, shared purpose, and guiding principles, as well as dynamically aligned interests and expectations.

My recent research takes a broader, system-level perspective. Building on prior research, I highlight that where a company and its management try to convince stakeholders that its purpose is something beyond the maximization of short-term shareholder value, stakeholders are skeptical. They watch keenly to see whether the CEO and the managers who work for them will reward their contribution beyond what is required to create value for shareholders. This skepticism leads to less upfront cooperation and more ex post conflict from stakeholders who are all focused on getting their fair share of the pie. As a result, the potential value created (i.e., the size of that pie) is limited by stakeholders who fail to offer value-creating innovation or contest the distribution of value created. Even shareholders are worse off.

By contrast, where a company and its management makes it clear, through their dialogue with stakeholders, structuring of an inclusive stakeholder network, and attending to those stakeholders’ most salient issues, that their purpose is harmony in their stakeholder system (i.e., growing the pie instead of dividing it or refusing to accept trade-offs), each and every stakeholder makes larger contributions and engages in less conflict. Firms are also better able to weather crises. Total value created and distributed is enhanced — including to shareholders.

Arguments about growing the pie or embracing the “power of and” are well established, but they struggle to explain how firms overcome stakeholder skepticism and shift their organization’s purpose. Some argue that such an outcome is difficult or akin to a prisoner’s dilemma, because any one stakeholder in the system will have the incentive to take the money and run. In other words, after contributions have been made without contractual guarantees for compensation, one stakeholder can grab more of the value than others perceive as fair, destroying the fragile system of cooperation.

However, I argue that contributions, beyond the terms of formal contracts, can actually be maintained because each member of the stakeholder system who sees the benefits of the shared purpose helps reinforce norms of cooperation across the entire system. Where one stakeholder, whether it’s a CEO or manager or customer or supplier or community member, violates the norms and seeks to grab a share of value perceived as unfair by their peers, the full set of stakeholders act to punish this deviant behavior. The threat of punishment and even ostracism by peers, where the clarity of shared purpose is strong enough, can mitigate the threat.

It’s easiest to see these system-level effects when firm behavior leads multiple stakeholders to reassess their relationships. Consider the defection of NGO partners, managers, and community partners from BP in the aftermath of the Deepwater Horizon disaster. Research has even shown that the NGOs that cooperated with BP also lost supporters while those who had previously challenged BP gained them.

By contrast, when firms form alliances with NGOs, research has found that the NGOs’ allies are less likely to criticize the firm. For example, after Coca-Cola partnered with Greenpeace, it experienced fewer attacks from Friends of the Earth and Sierra Club, both of which had targeted the company in previous years. Such networks of support from a diverse group of customers, NGOs, and government officials benefit firms with strong stakeholder orientations like Best Buy under the leadership of Hubert Joly or Unilever under Paul Polman.

These examples highlight the need to view stakeholders and firms as part of an interconnected system. In this system, much as in human social interactions, stakeholders not only make choices about whether to maintain their existing relational contracts and build new ones, but also whether to punish or reward their peers for their choices of relationships.

In order to support and demonstrate the efficacy of such sanctions, however, stakeholders and academics both need more data. First, we need to be able to identify stakeholder-oriented firms from those that virtue claim or engage in greenwashing, as well as peers who contribute to instead of exploiting the system. Required data includes information on the total value created by a firm, not just its shareholder value. Second, we need information on stakeholder sentiment toward firms (and each other), including on issues of particular concern. Finally, we need to see if firms’ efforts to claim a stakeholder orientation are backed by actions and outcomes (i.e., are they “walking the talk”). In a recent working paper, I link these three types of data to show that firms that deliver on issues of concern gain stakeholder support and enhance shareholder and total value. This work and much more to come seeks to build a robust empirical body of evidence on the value of organizational purpose.

The value of organizational purpose is to coordinate stakeholder harmony and punish self-interested behavior by stakeholders in such a system. Such purpose engages stakeholders, binds them together, and motivates them to move forward on a journey that is meaningful to each of them. Such purpose inspires individual stakeholders to make the effort to achieve unknown and unknowable system-level collaboration. Achieving such clarity on a shared sense of purpose is the canonical challenge of modern management.

Copyright 2023 Harvard Business School Publishing Corporation. Distributed by The New York Times Syndicate.

Topics

Motivate Others

Influence

Adaptability

Related

A Metaphor for a Happy Marriages?Get Off the Transformation TreadmillBeing Adaptable Isn’t Enough. You Have to Demonstrate It.Recommended Reading

Motivations and Thinking Style

A Metaphor for a Happy Marriages?

Motivations and Thinking Style

Get Off the Transformation Treadmill

Motivations and Thinking Style

Being Adaptable Isn’t Enough. You Have to Demonstrate It.

Professional Capabilities

Championing Physician Leadership Development: AAPL's Five-Decade Commitment Meets Healthcare's Critical Moment

Professional Capabilities

“Profiles in Success”: Certified Physician Executives Share the Value and ROI of their CPE Education

Professional Capabilities

Case Study: How Do I Come Back After a Career Break?